Tuesday, October 31, 2006

Thursday, October 26, 2006

Answering Questions

There was a recent comment on one of my posts that I was lazy about replying to comments. So, I’m replying to a couple of comments that have been posted on this blog.

There have been a couple of posts regarding my recommendation on Partygaming. The posts state the following:

1.) Partygaming has lost its U.S. players.

2.) Everybody is selling it (including large institutions) and that's why it's going down.

3.) Partygaming is not a safe investment because it’s going down.

Here is my reply to these 3 statements...

1.) Everybody knows this and my valuation of Partygaming do not take into account the U.S. players

2.) Who cares is if everybody is selling it and usually stocks go down when people are selling.

3.) Just because a stock goes down, it doesn't say anything about the risk of the investment.

Now some people who are posting comments are missing the point of this blog and the point of value investing. Value investing is about making logical, rational decisions. Value investors profit when other investors make emotional decisions. The people who posted comments gave no real reason why they think Partygaming is a bad investment, but simply stated that it will go down because other people are selling it or that U.S. players are not allowed to play on the site. In fact, I see Partygaming as the perfect value play. Luckily, I was able to add 15,000 more shares at .5575c this week. This is in addition to the 8,000 shares I bought at .74c. I will try to buy more.

The other question was on currency trading. Now I am not smart enough to do currency trading. If you feel you have an edge in currency trading, then by all means go for it. If I did currency trading, it would purely gambling on my part. Long term currency is affected by many factors such as the health of the economy, interest rates, etc… I am not a macroeconomic expert and neither are most small investors. So, I would leave currency trading alone. Why would you do currency trading when stocks are so much easier to pick???

Saturday, October 21, 2006

Shorting Stocks

However, shorting stocks is far more dangerous and far less profitable than simply just buying a stock because generally stocks tend to go up (U.S. stocks have had a historical 7% inflation adjusted return) Also, the maximum you can lose buying a stock is 100%. But, in shorting stocks, your loss is infinite. Even, if you are correct in analyzing that a stock is overvalued, it might take time before the market realizes this. And you could be broke by that time.

Because of these dangers, you shouldn’t short stocks. If you do decide to short, you should do it with a very small percentage of your overall portfolio. In my next blog, I’ll examine what you need to understand about a stock before you short. Also, I’ll give you some examples from stocks I’ve shorted and try to come up with a stock that could be a short in today’s market.

Wednesday, October 18, 2006

Bush signs Gambling bill

Although, I was able to buy 8,000 shares at .74c, I haven’t been able to buy any more shares. These shares trade over the counter in the U.S. and because of this, they do not have much liquidity. Today, I tried buying 15,000 shares at .58… then at .59c… then at .60c… all the way up to .63c… but it didn’t go through. The shares closed at .62c. This is the first time I’m buying an OTC stock. Anybody have any idea on how to better execute my purchase?

Friday, October 13, 2006

Bought Partygaming

Wednesday, October 11, 2006

TSY-PC undervalued preffered

TSY-PC (Trustreet Properties) is a 7.5% convertible, cumulative preferred stock with a liquidation value of $25. This means it pays a $1.875 ($25*.075) dividend every year. Obviously, as the stock price goes below $25, the dividend as a percentage goes up. Currently, the stock is trading around $21. This means you are getting about a 9% dividend. Pretty good.

Also, at any time you can convert this preferred stock into 1.28205 shares of the parent

company TSY. At the present time, TSY trades near a 52-week low of $12.5. So, obviously it doesn't make sense to convert them. But, essentially on top of the 9% dividend, this is lottery ticket that comes with buying these shares. For example, if by chance TSY stock rebounds and goes to say $19.5, the preferred stock will trade around $26. TSY, after 2/25/2009, has the right to buy these shares for $25. So, now the only thing you have to worry about is TSY going bankrupt and potentially losing all of your investment.

TSY is a REIT that owns restaurant properties. The company is very stable and has nearly $1 billion is shareholder equity. So, the company isn't going to go away anytime soon. In the very rare case of bankruptcy, preferred shareholders are next in line after debt holders. So, that's why shareholder equity is important to look at when you analyze any preferred stock. This is a great investment for people looking for some income with the added upside of owning a stock. I own 500 shares at around $20. A great place to look for preferred stocks is http://www.quantumonline.com/

Monday, October 09, 2006

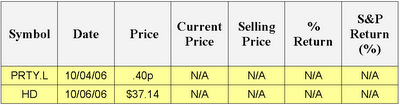

Option on HomeDepot

First, it’s hard to grow when your revenues approach $100 billion a year. There do-it-yourself outlets are so saturated that new stores are “canabalizing” older stores. So, as I mentioned before, the growth will either have to come from Home Depot supply or from international growth.

Second, the housing market is cyclical. Even though I don’t think the effect of the housing downturn will be as much as most people fear, it will still have an impact on growth. Since, the housing market was strong the last couple of years, the growth of over 15% is somewhat of an abnormality.

Now, I have no idea what the future growth will be, but I think it will be somewhere between 0 and 15%+. So, it has to trade with a P/E between 12 and 20. Conservatively, I think it should trade at 15 times earnings or $45 dollars. If this analysis is correct, an investor would make 20% on their investment.

Although, a 20% return is pretty good. There is another way to increase return with the use of options if you are sure about the performance of HD stock.

The easiest and safest strategy is to write a spread. For example, I sold a Jan 2009 $45 call and I bought a Jan 2009 $35 call at a net price of $3.50. If HD is $45 on Jan 2009, I will be able to sell it for $10 and make a 200% return. If at anytime, the stock goes up, the net price will rise. I bought 22 of these options for a net price of $3.50 or $7,700. The price is around $4.30 now. So that gives me over a 20%+ return. I bought it when HD was trading a little over $34. Of course, If HD stays below $35 on Jan 2009, I will lose all my money. :-)

Another options strategy is to buy a Jan 2009 call and sell a Jan 2009 put (synthetic buy). The net price should be somewhere in the $4 range at the current price. It essentially allows you to buy a share of HD. Obviously the returns are much nicer if HD goes up. This strategy is a little bit riskier because you could lose $39 if HD goes to 0. However, the upside is unlimited and better than the aforementioned options strategy.

If all of this is too confusing, you should just buy shares of HD. However, I feel options are the way to go with HD because of the fact that the shares have little downside.

Sunday, October 08, 2006

Partygaming in Barrons

As to the authors claim that Partygaming could face a potential cash crunch situation because of all the U.S. players cashing out, he conveniently forgets to mention the cash that the company will have earned since their last June 30 balance sheet statement. Before the U.S. legislation, Partygaming was earning $60 million dollars a month. That comes out to approximately $180 million at the end of September. This should be enough to satisfy the $192.6 million it owes its clients (not all clients are U.S. and not all will cash out). And from what I can see, the U.S. players aren’t cashing out just yet. As I’m writing this, 80,000 players are playing on Partypoker and most of them are from the U.S. And even if all these players cash out, as I mentioned in my previous article, I think Partygaming would still be a buy.

Friday, October 06, 2006

Home Depot

By my aforementioned statements, you should realize that I think Home Depot is considerably undervalued. Now, I’m not going to go through a discounted cash flow analysis to prove my point (On this blog, I will never do that). Because most of the time, I feel this type of analysis is useless. You can make your stock go up or down by +-25% depending on what growth rate you chose, what risk free interest rate you choose, etc… Most of the time, you don’t need this nerdy, mathematical analysis to figure out whether something is cheap or not. And also, it’s pretty boring.

Home Depot is undervalued for one reason. If Home Depot kept its earnings steady (~$3.00/share) for eternity, and paid out all it’s earning in dividends, I would still buy the stock today. Because at $37, I would be roughly getting a dividend of 8%. The best I can do is a 6% 16-month cd at Digital Credit Union. This is probably the worst case scenario.

The reality of the situation is that it doesn’t pay an 8% dividend. It is much better. Home Depot is a cash flow machine with a great business. They pay nearly a 2% dividend and buy back almost 4% of their shares and still manage to grow their earnings by over 15% the last couple of years. Pretty incredible.

However, even when I spit out these numbers, there are a lot of skeptics. The biggest complaint that people have is that housing is crashing. Yes, it’s true that housing is cyclical and might crash (home building stocks have certainly crashed). But I don’t think that’s really going to affect Home Depot all that much. If people need to fix something in their house, they will have to go to Home Depot. Sales will be down from people refinancing their house and doing some fancy project like remodeling the kitchen. But overall, it should not affect sales dramatically. Also, this is cyclical and not a long term issue (value investing). The housing crash might have more of an affect on Home Depot Supply, which caters to professional customers (contractors, businesses). However, this again is a short term issue and Home Depot supply is a much smaller contributor to revenue than the do it yourself retail outlets.

The second complaint I get is that, Home Depot will not grow that much since they are everywhere in the US. But based on past numbers (15%), they seem to be growing nicely. I agree that growth will be slow in the do-it-yourself outlets without strong same store sales. However, they are expanding in the professional customers market with Home Depot supply. This is where the real growth will come in the upcoming years. But even if I’m wrong and there is no growth, Home Depot still beats my 6% cd.

My next blog will feature how you can use options to magnify your returns with Home Depot… as much as a 200% return if we are right… I own 500 shares of Home Depot at an average price around $35 and I also have options (next blog)...

Wednesday, October 04, 2006

Recommended Readings

Another book that I highly recommend is Buffett, The Making of an American Capitalist by Roger Lowenstein. This book illustrates Buffett’s intellect, character and most importantly, his singular belief in himself. It also has his thinking behind some of his greatest investments including American Express, Washington Post and Coca Cola.

The classic book that all investors should read is Intelligent Investor by Benjamin Graham (Buffett’s mentor). Although this book is was originally publish over 50 years ago, its ideas are still very much relevant today. This book is not an easy read, but lays out the philosophy of value investing very well.

Tuesday, October 03, 2006

PartyPoker

As you may have heard, a bill passed that would make playing online poker extremely difficult. The poker bill was attached to a port bill that was highly popular. So the poker bill easily went through even though there were a number of people against it (democrats). Anyway this bill will make it very hard for people to fund their poker account because it will stop banks and credit card companies from funding gambling sites. Contrary to my opinion and the state of

As a result, partygaming, the company that owns the most popular online poker room, partypoker.com, said they are going to stop accepting real money play from US customers once Bush signs this bill into law. This seems a near certainty. Although he might get a bump up in opinion polls if he did veto it, but i doubt it. Anyway, since partypoker's revenue is primarily derived from US (77%), the stock tanked. It went down over 60% on Monday.

So, usually when stocks go down a lot it gets me interested to see if the stock is a good buy.

Partygaming trades around .75c-.80c in the

If there is no growth from the first half of this year to the second half of this year, they will have international revenue of $150 million the second half or $300 million for the year. Last year the growth form first half to second half was 50%. So even if the growth is a reasonable 33% from first half to second half of this year, they will have international revenue of 200 million in the second half or $350 million for 2006. At 50% earnings margin, they will earn $175 million dollars or 4.5 c/share. That give you a p/e of .80/4.5 or around 18. This does not even include the

A p/e of 18 is pretty good for a company that just experienced 150% growth. Also, partygaming is a cash cow. There is hardly any capital expenditure for growth. All you need to grow is to buy more servers, hire more people and spend some money on marketing. The rest of the cash can be used to pay dividends or buy back shares. Partygaming was just about to pay a 115 million dollar dividend before this law passed.

Also, if for some insane reason, this bill does not go through, the shares would really jump. They were on track to earn .20c this year. .80/.20 is a p/e of 4.

There is also a chance someday that the

The downside of this stock is that competition for online gaming is immense. This could dampen margins in the future. Also, since the number of players playing on partypoker will significantly decrease, this might decrease the number of different types of poker games that they can offer. This will have a negative affect on international revenue. There will be one time charges because of the unwinding of the

But, overall this stock is worth investing in. It is hard to find a stock that has a p/e of less than 20 with 150% revenue growth. Poker is exploding all over the world like it has in the

I put in an order to buy today for 5,000 shares at .76c, but it didn’t go through.